Grow your wealth – scientifically and safely

Equity-focused strategies guided by science – crafted to grow wealth safely over the long term.

1200

Cr Peak AUA

12000

Investors

40

Years of Combined Team Experience

3

Founders from IIT / IIM / Columbia

Featured In

How Scientific Investing Works?

Many investors make decisions based on market noise, short-term trends, or stock tips—strategies that may lack long-term rigor or risk control.

At OmniScience, we use a structured, proven system called Scientific Investing, developed by Dr. Vikas Gupta (IIT Bombay, Columbia University), based on over 100 years of investment research and tested across multiple market cycles.

Our approach is built on 3 pillars:

First-Principle Thinking

We strip away market myths and rebuild our investment strategy from foundational truths that have stood the test of time.

Decades of Global Research

Our models integrate insights from 100+ years of financial data and academic work on what drives sustainable returns.

A Safety-First Framework

Risk is never ignored. Every investment decision prioritizes capital preservation alongside growth potential.

Meet the People Behind the Portfolios

CEO & Chief Investment Strategist

Vikas founded OmniScience Capital to offer a scientific approach to equity investments in global & Indian stock markets. He holds a B.Tech. from IIT Bombay and an MS & Doctorate from Columbia University, New York. His “OmniInsight” lies at the heart of our methodology. He’s a regular contributor in global and Indian financial media.

VP – Quantitative Research

Varun co-founded Omniscience and leads quant research, analyzing over 5000 firms globally to craft SuperNormal portfolios. Previously with Trefis, he covered US Tech & Defense stocks (Google, Amazon, Boeing, etc.). He holds a B.Tech. from IIT Roorkee and an MBA from IIM Bangalore & EDHEC France.

Explore Our Curated Portfolios

Our curated smallcases are

🧠Backed by deep quantitative and fundamental research.

🌪️Built to withstand volatility and economic cycles.

🏦Designed for long-term wealth creation with safety at the core.

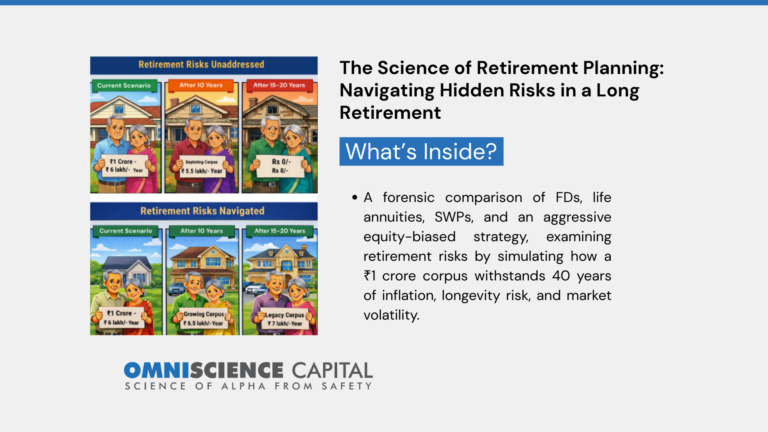

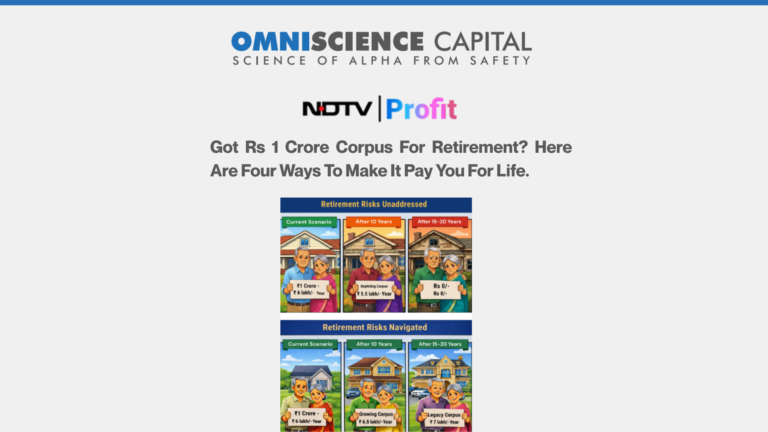

From the OmniScience Knowledge Vault

We don’t just invest — we educate. Here are some of our most valuable insights, tools, and resources.

OmniScience Capital

Science Of Alpha from Safety

Many investors make decisions based on market noise, short-term trends, or stock tips—strategies that may lack long-term rigor or risk control.

At OmniScience, we use a structured, proven system called Scientific Investing, developed by Dr. Vikas Gupta (IIT Bombay, Columbia University), based on over 100 years of investment research and tested across multiple market cycles.

Download Today

Access Your Portfolios Anytime, Anywhere

Track your portfolio, explore new smallcases, and invest — all from your phone.

Available on Android & iOS.

FAQS

What Types of Investment Products Do You Offer?

We offer a range of investment solutions, including Core strategies and Thematic strategies, both designed for long-term growth, along with Multi-Asset products focused on diversification and risk management.

How Do I Get Started Investing in Omniscience Smallcase?

Invest with Omniscience Capital on Smallcase

Start your investment journey in just a few steps:

Subscribe and start investing seamlessly.Open a Smallcase account and link your demat. Explore our portfolios here: 👉 Omniscience Smallcase

Once your account is set up, visit the following link to explore our curated smallcases:

👉 Omniscience Smallcase

How Do Thematic Strategies Differ from Core Portfolios?

Core portfolios focus on broad market stability and long-term growth, while Thematic strategies target specific trends and industries with high-growth potential.

Both are designed for long-term investment but differ in approach and focus.

Do You Offer Investment Opportunities in Global Equities?

Yes, in addition to Indian equities, we provide investment solutions in global equities, allowing investors to diversify their portfolios across international markets and capitalize on global opportunities.

Stay ahead of the curve. Invest with clarity.

Get expert insights on markets, portfolios, and the economy—delivered where you want them.

Join the OmniBytes Whatsapp Community

Get bite-sized insights and timely updates on your phone—perfect for busy investors who want to stay informed.

Don’t invest blindly. Learn the science behind wealth creation.

Subscribe To Our Newsletter!

A weekly dose of financial intelligence straight to your inbox—market insights, portfolio tips, and smart investing ideas.