Scientific Investing for SuperNormal Portfolios

Safety-first alpha for HNIs & UHNIs.

Omniscience PMS unites data insights and fundamental discipline to generate consistent, long-term SuperNormal returns.

Multiple PMS strategies designed for growth,income, and diversification.

Vikas Gupta, Ashwini Shami and Varun Sood – Founders of Omniscience Capital

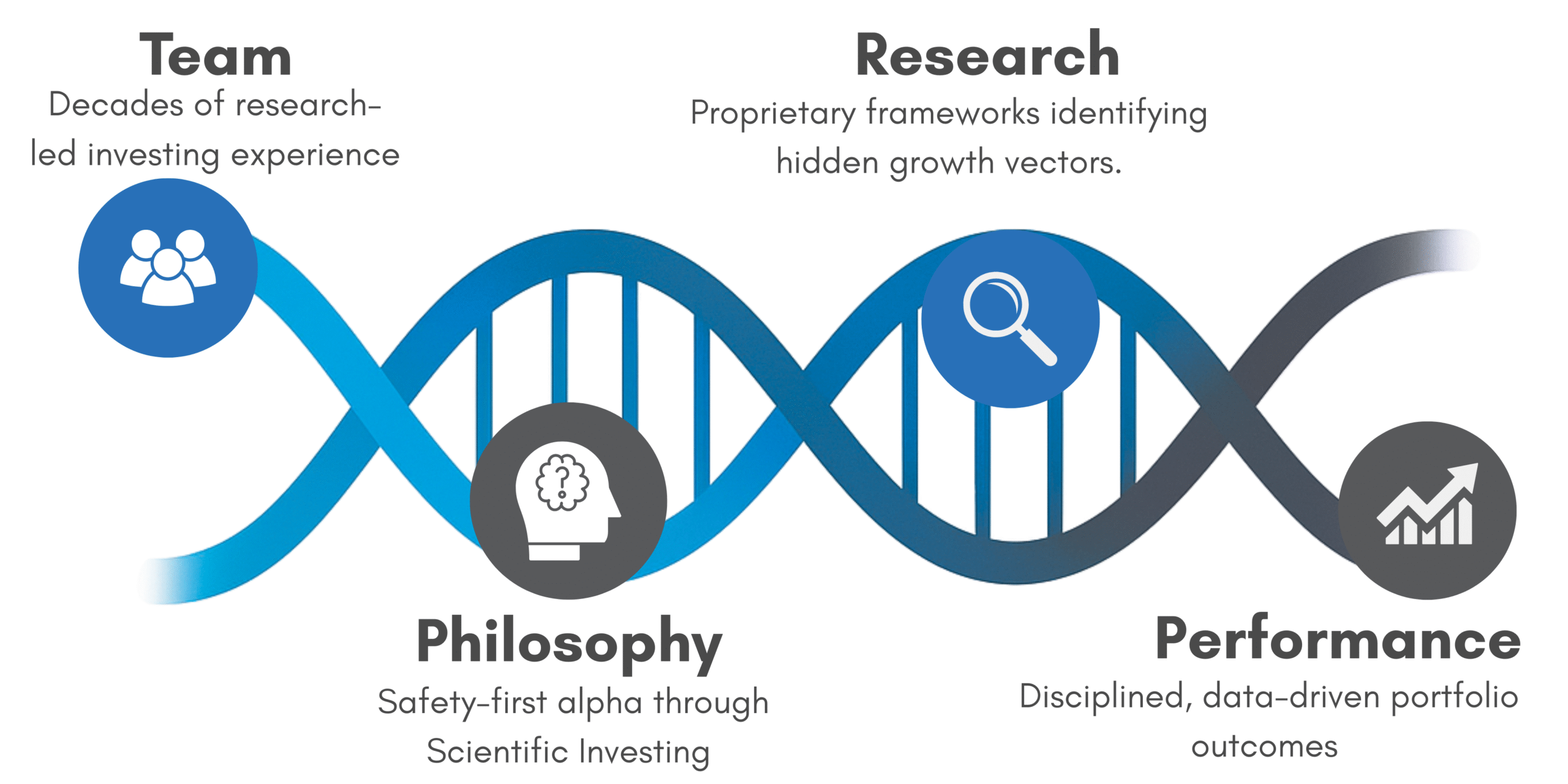

Omniscience DNA

The core framework that defines how we invest and operate.

Scientific Investing in Action

Every Omni PMS strategy is founded on Scientific Investing – a proven process that translates a century of research into a repeatable framework for wealth creation.

Enhance Safety

Eliminate capital destroyers to protect the downside.

Enhance Growth

Spot capital multipliers and below-the-radar growth vectors.

Enhance Returns

Construct SuperNormal portfolios that combine safety with growth.

Explore Our PMS Strategies

Choose the approach that best aligns with your goals and investment philosophy. Each strategy is built on Omniscience’s Scientific Investing framework – a process designed to enhance safety, growth, and returns.

Omni Crest

For the Accomplished and the Disciplined Investor

For successful, discerning investors who value stability, quality, and long-term compounding. Omni Crest invests in proven Indian businesses across market caps, guided by the Scientific Investing Framework and key growth vectors.

Omni Inevitables

Investing in India’s Core Growth Vectors

Omni’s forward-looking PMS strategies focused on the sectors shaping India’s next decade. Omni Inevitables capture long-term growth across financialization, infrastructure, sustainability, and technology—the engines of tomorrow’s India.

Omni Institutional

Designed for Family Offices & Institutional Investors

Designed for family offices, institutions, and enterprises seeking stability and diversification. Omni Institutional blends Indian equities with global, commodity, and fixed-income exposures for steady, balanced compounding.

Explore Our PMS Products InDetail

Why Choose Omni PMS?

Safety-first philosophy

Alpha driven by risk elimination before reward.

Research-backed process

100+ years of investment insight distilled into a scientific method.

Transparent, disciplined risk management

Construct SuperNormal portfolios that combine safety with growth.

Featured In

Choose the approach that best aligns with your goals. All strategies are managed within our Scientific Investing framework

Performance, Reported Transparently

We publish performance data for every Omni PMS strategy – filed monthly with SEBI and updated regularly for our investors.

Our commitment to transparency means you always know how your portfolio is performing.

Talk to Our PMS Team

Our PMS specialists will help you understand which Omni strategy best fits your goals.